By Mike Baños

The Phividec Industrial Authority (PHIVIDEC IA) and the Philippine Economic Zone Authority (PEZA) have partnered to attract more locator industries in the 3,000 hectare Phividec Industrial Estate in Misamis Oriental (PIEMO).

Last week, PEZA Director General Tereso O. Panga met with PHIVIDEC IA Administrator & CEO Atty. Joseph Donato J. Bernedo to discuss joint measures to lift the PIEMO’s presence and profile in the nation’s capital.

PEZA

“I purposely reached out to the Administrator because we really want to promote Phividec,” said DG Panga. “We’re now seeing more interest in Phividec because of the reforms happening, this is the best time to promote Phividec. We don’t want to pass up any more big ticket investments.”

“This is my first time to meet with DG Panga and we discussed how we can be properly assisted before Phividec-IA starts registering new locators in the PIEMO by virtue of its new mandate under the CREATE law to directly register enterprises for incentives,” Atty. Bernedo said.

Although some PIEMO locators such as the Philippine Sinter Corporation (PSC) and Jacobi Carbons previously registered directly with PEZA, Bernedo said they are exploring how to attract more locators by enabling them under provisions of the CREATE Law and remaining provisions of the PEZA Law to access special incentives which PIA is allowed to directly facilitate as a special economic zone and investments promotion agency.

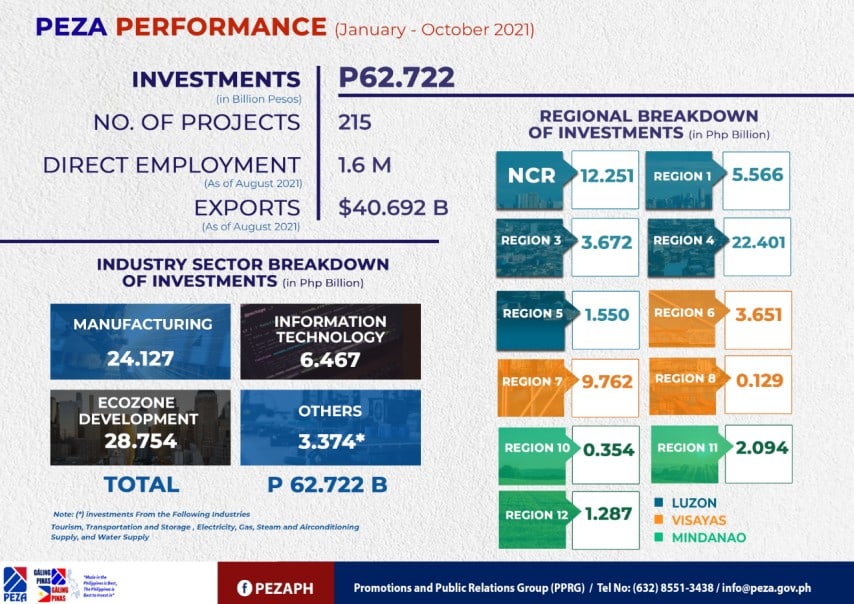

PEZA Performance by Region (Jan-Oct 2021)

The CREATE law provides measures that rationalize the grant of fiscal incentives to targeted investors given that for decades, the Philippines has been too generous in granting tax incentives to a few investors, in perpetuity, and without a regular and in-depth review of the costs and benefits of doing so.

DG Panga noted the prevalence of some issues which made it previously difficult to bring in investors and engage them with the administration because of the perceived politization of the decision making process.

However, with the increased transparency under the new administration, PEZA now sees its role as enablers.

“We have the president promoting the country to global investors. So our role is more than promotion, it’s really facilitation. This is the message we’d like to share with all our LGUs, our ecozone developers, to help us promote investments,” he added.

As an Investment Promotion Agency (IPA), Atty. Bernedo said Phividec has been receiving inquiries from interested locators.

“Once they formalize their intentions, we will process their applications, and if they pass they will be registered as locators, and then we can directly register them for benefits under the CREATE law without need to endorse them to PEZA,” he noted.

PHIVIDEC Industrial Authority

The PHIVIDEC IAs lack of presence in Metro Manila (except for a small business office) has also been cited as another factor which contributes to its inability to bring in large locators.

“If we coordinate with PEZA, especially for their existing locators that need additional space, then it would be a big help to bring them to Phividec”, Atty. Bernedo added.

“But looking at the share of Northern Mindanao, it’s so small, with total PEZA investments only at one percent and there’s huge potential. But because of Open access and the WESM, the first item we really have to address because you already have the location already is power,” DG Panga said.

He cited how the STEAG State Power Inc. (SPI)’s 200MW coal-fired power plant is located right inside the estate but neither the PIA nor any of its locators can source power directly from them.

“Even with PEZA registered sunset locators in Phividec, we don’t take it as absolute. So if one day they decide to register under PIA, we have no problem with that because we both are still under government,” he added.

President Marcos Jr. recently vetoed the Sunset Provision for Existing Registered Business Enterprises which called for the removal of the extension of availment of tax incentives by existing RBEs because the “extension of incentives for existing projects is unfair to ordinary taxpayers / unincentivized enterprises and further, only new activities and projects deserve fresh incentives.”

####