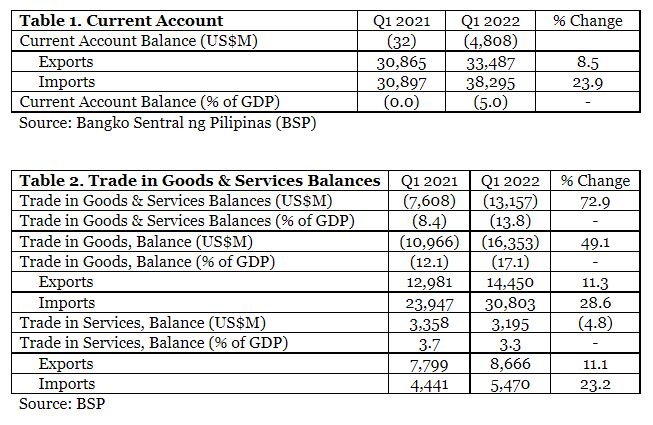

The current account in the balance-of-payments moved to a deficit of US$4.8 billion or 5.0% of GDP in the first quarter of 2022, as imports rose by a hefty 23.9% and exports by 8.5%. The widening deficit was due partly to the rapid recovery of capital formation and industry which expanded by 20% and 10.4%, respectively, as the economy prepared for higher demand. The economy has been on the recovery path since the second quarter of 2020. (Table 1)

Another big contributor to the deficit is the US$3.2 billion rise in petroleum product imports as prices rose 52% due to higher demand as a result of global recovery, and tighter supply and speculation that accompanied the Russian invasion of Ukraine.

The current account is the balance between exports and imports of goods and services, and overseas incomes and payments. This is the equivalent of the investment-saving gap, an indicator closely monitored by credit rating agencies.

The deficit in the trade in goods balance rose from 12.1% of GDP in 2021 to 17.1% of GDP in 2022. Imports rose rapidly because capital goods and industrial raw materials account for 67% of total imports. The higher deficit, in addition to the surge in the value of the US dollar, contributed to the 6.7% year-on-year depreciation of the peso as of end-March. (Table 2)

The surplus in the trade in services slipped from US$3.4 billion to US$3.2 billion and as a % of GDP, from 3.7% to 3.3%. Earnings from BPOs rose by 9.4% but badly affected travel and tourism receipts still lagged 66.5% below last year’s level.

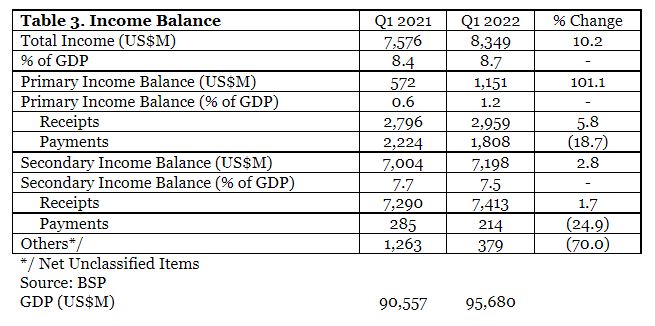

Primary income balance which represents the country’s earnings from placements abroad less earnings by other countries from local placements soared from US$572 million to US$1.2 billion as global businesses began to stir from last year’s economic slump. (Table 3)

On the other hand, secondary income balance which represents remittances accruing to OFWs less incomes of expatriates remitted abroad increased from US$7.0 billion to US$7.2 billion.

DOF View

The current account balance moved to a deficit in 2022 as the economy roared back to life from the global health crisis, boosting import demand more than export demand. The main beneficiaries of this development are investment and industrial production which both grew at double-digit rates.

Maintaining good fundamentals by keeping both the budget deficit and balance-of-payments manageable, keeping interest rates at the level that sustains investment while taming inflation, and allowing the exchange rate to maintain its competitive level will allow the country to recover promptly as it gradually eases the lockdowns set up to battle the pandemic.

-oOo-